What’d you see the last time you scrolled through your Instagram feed?

If you’re like me, you were bombarded with selfies, pictures of delicious-looking food, videos of people’s pets, and inspirational quotes.

And probably not too many interesting posts from small businesses.

The sad fact is that lots of small businesses aren’t even on Instagram. Often, they either don’t want to learn how to use it or they don’t think it’ll help them improve their business.

But they’re wrong. Instagram can help your small business succeed.

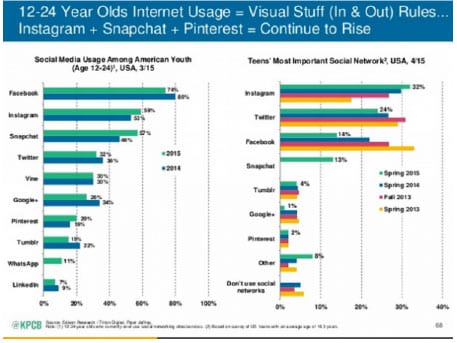

And that especially applies if your ideal customers are anywhere from 12 to 25 years old. Just take a look at how popular the app is with that audience:

But even if you’re marketing to an older demographic, Instagram is worth your time. After all, at 4.21%, brand engagement rates highest on Instagram. That’s right – it beats both Twitter and Facebook.

So, let’s talk about several ways you can use Instagram for your small business to effectively to engage with your audience and get better results from your social media marketing efforts.

1. Find, follow, and interact with your ideal customers

Finding your ideal customers on Instagram isn’t too difficult. The first thing you should do is look at the accounts who are following businesses similar to yours – if they’re following them, then they’re probably going to be interested in what your business has to offer too.

For example, if you’re a fitness guru who sells online weight loss courses, you’d want to follow some of the people who follow popular fitness gurus. If you’re a marketing agency, you’d want to follow some of the people who follow popular marketing agencies.

You get the picture.

Now, don’t get me wrong – not all of the people you follow will follow you back. But some of them will, and there’s a good chance they’ll engage with you if you’re posting the right content.

Then, you can start interacting with those people by commenting on their photos, liking their photos, and even sending them direct messages.

But keep this in mind:

If you spam people or write generic comments that aren’t tailored to fit the photo/account you’re commenting on, you’ll just hurt your brand and annoy people. Take the time to really form a genuine connection with your audience, and your efforts will eventually pay off.

2. Create content that appeals to your target audience

You know your target audience, but do you know what kind of content will make them engage with your brand on Instagram?

If not, it’s time to start researching. Take a look at your competitors’ accounts, and figure out which kinds of photos get the most engagement there. Of course, you don’t want to steal those photos, but you can certainly use them as inspiration when you’re creating your own posts.

If you’re not sure what kind of content to post on Instagram, here are a few ideas:

- Behind-the-scenes videos

- Inspirational quotes

- Employee selfies

- Blog post images

- Product sneak peeks

- Product arrangements

Try several (or all) of these, and see what gets the most engagement. Then, you can change your posting strategy based on what your audience likes best.

3. Fill out your bio strategically

Instagram isn’t LinkedIn – it’s much more casual. That means there’s no need for you to write a stuffy, boring bio full of business jargon.

Instead, opt for a more lighthearted feel to humanize your brand. Think about your ideal customer, and write your bio in a way that appeals to them.

As far as formatting, you can use emojis, vertical spacing, and other tricks to help your bio stand out from the crowd. Just take a look at this bio:

See how Lime Crime uses vertical spacing and emojis? Their bio formatting looks much more interesting that it would if it were just a boring sentence about their company.

I’m not saying you absolutely need to use emojis or vertical formatting. Think about your target audience and what they might like to see in your bio, and take a look at what you most successful competitors are doing. From there, you can make an informed decision about how to format your bio.

Tip: While it’s good to be creative in your bio, you shouldn’t sacrifice clarity for the sake of creativity. Make sure your bio states what your company does in a way that allows the people who view your profile to immediately understand it.

4. Post high-quality photos

Don’t worry – you don’t need professional photography skills or even a good camera to pull this off. All you need is your iPhone camera.

Here are a few DIY photography tips you can use to improve your photo quality:

- Use natural light to your advantage. If you’re shooting outdoors, try to take the photos in the late afternoon when the lighting is best. If you’re indoors, just open up a window (or your blinds) and you’ll be good to go!

- Don’t use the front facing camera if you can help it. Using the back camera on your smart phone will often result in higher-resolution photos.

- Edit your photos. Do not (I repeat, do NOT) use the default filters included in the Instagram app! Instead, download a photo editing app and make a few adjustments until your photo looks like it was taken by a professional.

If you’ve got an iPhone and would like to learn how to use it to take amazing photos, check out the iPhone photography school blog. It’s full of tips that’ll help you boost the quality of your photos!

5. Use hashtags

When you’re using hashtags, think about what words your target market might be searching for that also apply to your photo. For example, if you’re running an entrepreneurship blog and posting inspirational quotes to your Instagram account, you might try using hashtags like #entrepreneur and #mondaymotivation.

Whatever industry you’re in, use the Hashtagify tool to research and determine the best hashtags to use for your business and target audience. When you type in a tag, you’ll get other tag suggestions, like this:

Experiment with different hashtag combinations and see which work the best. As long as your hashtags are relevant to the photo you’re posting and your target audience, they should be fine.

A word of warning:

Don’t overdo it with your hashtags. If you include 15+ hashtags every time you post a photo, you’ll look spammy and desperate, which will hurt your brand. Trust me – that’s not worth any amount of likes.

So, how many hashtags should you use?

Try sticking with 3 to 5 hashtags per post. That way, you can include enough hashtags to drive engagement but not so many that your account looks ridiculous.

6. Offer discounts

If your small business is an eCommerce store, you can get new followers and keep existing followers around by offering exclusive discounts on your Instagram account.

All you need to do is create a graphic that shows the discount percentage and discount code (you can easily do this using Canva), then explain how to use the code in your caption.

But you don’t have to be an eCommerce store owner to use this tip. Get creative, and figure out a way to offer exclusive discount for the products and/or services you offer.

7. Make sure your feed is cohesive

To create a strong brand on Instagram, you need a cohesive feed. Ideally, your pictures should stick to a similar color scheme (if you have a brand style guide, use it), and you should use the same filter and/or editing process for each photo you post.

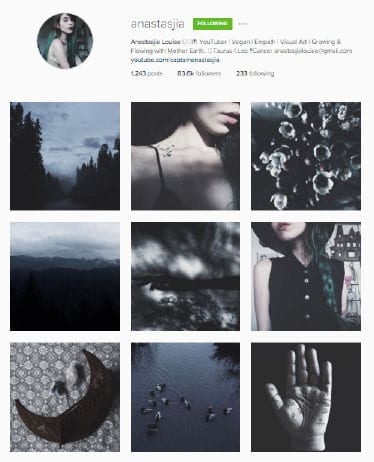

Let’s take a look at a good example of a cohesive Instagram feed. It belongs to YouTuber Anastasjia Louise:

You can see that she sticks to a dark theme, and her pictures are mostly black and white. As a result, her feed is visually appealing and you immediately get a strong sense of her personal brand when you look at it.

But you don’t necessarily need to stick to a dark theme like her. Think about your audience and what types of photos are most likely to appeal to them. Then, create a cohesive feed by using a photo editing app like Afterlight or VSCOcam to create a custom editing process.

When you use one of these apps and edit a photo the way you like, edit all of your other photos that way too. This is one of the most important steps when you’re trying to create a cohesive feed.

You’ll also want to share the same kind of content consistently – that way, your audience knows what to expect (and they know it’ll be something they like!). Just make sure you monitor your results when you post and adjust your strategy based on which types of photos are getting the most engagement.

8. Craft some killer copy

Don’t underestimate the power of your copy when you’re writing captions for your Instagram posts. Those captions can be the difference between 1 like and 1,000 likes, so take your time while writing and make sure whatever you put there is good.

Also, keep in mind that Instagram captions can help you build your brand. If your brand is edgy, write something edgy. If your brand is positive and uplifting, write something positive and uplifting.

Whatever you decide to write for your captions, tailor the messaging based on your brand and target audience, and you’ll see better overall results from your Instagram marketing efforts.

In Conclusion

Just like anything else, the results you get from your small business Instagram account will depend on how much effort you put into it.

Follow the tips outlined here consistently, and you can feel confident knowing that you’ll soon see your following begin to grow. Keep it up, and who knows – Instagram marketing might just become one of your most powerful methods of connecting with new customers!